On March 1, 2024, in Ho Chi Minh City, DEOCA Group organized a conference on investing in transport infrastructure using the PPP++ model, attended by businesses, banks, investment funds, and partners.

Potential for investment in transport infrastructure

By 2030, the Government aims to have 5,000 km of highways according to the road network planning, involving the entire political system with specific mechanisms for project implementation.

Mr. Le Quynh Mai - Vice Chairman of the Board of Directors of DEOCA Group introduced the PPP++ model

The Government encourages private sector participation by providing state budget capital support for PPP projects, prioritizing businesses for investment, and offering long-term credit with preferential interest rates. Public investment projects can also be licensed for exploitation, with localities exploring revenue mechanisms from land funds to enhance investment effectiveness and increase construction value.

Government also gives attention to railway development in addition to roads. With Decision 1769/QD-TTg, the target is to invest in 9 railway lines spanning 2,362km by 2030. Land allocation for railways is planned to support urban development and functional areas (TOD model) for resource generation. Socialization of railway business and transport services is encouraged to attract investments from various economic sectors.

Government's commitment to finish 5,000km of highways by 2030 and advancements in high-speed railways present significant job opportunities for transport infrastructure businesses.

Former Transport Minister Mr. Ho Nghia Dung emphasized the need for private sector participation in transport infrastructure investment through PPP to meet the government's goals.

Mr. Ho Nghia Dung spoke at the conference

What opportunities are there for investors?

In 2024, DEOCA Group plans to invest over 82 trillion VND to construct 300km of highways and ring roads, including projects like Huu Nghi - Chi Lang, Tan Phu - Bao Loc, and Ho Chi Minh City - Chon Thanh, etc.

DEOCA presents the PPP++ model to efficiently raise capital for the project by diversifying funding sources, enhancing mobilization efficiency, and reducing implementation risks.

Projects under the PPP++ method have a diversified capital structure, including state budget, equity, credit, construction profits, bonds, stocks, and BCC contracts.

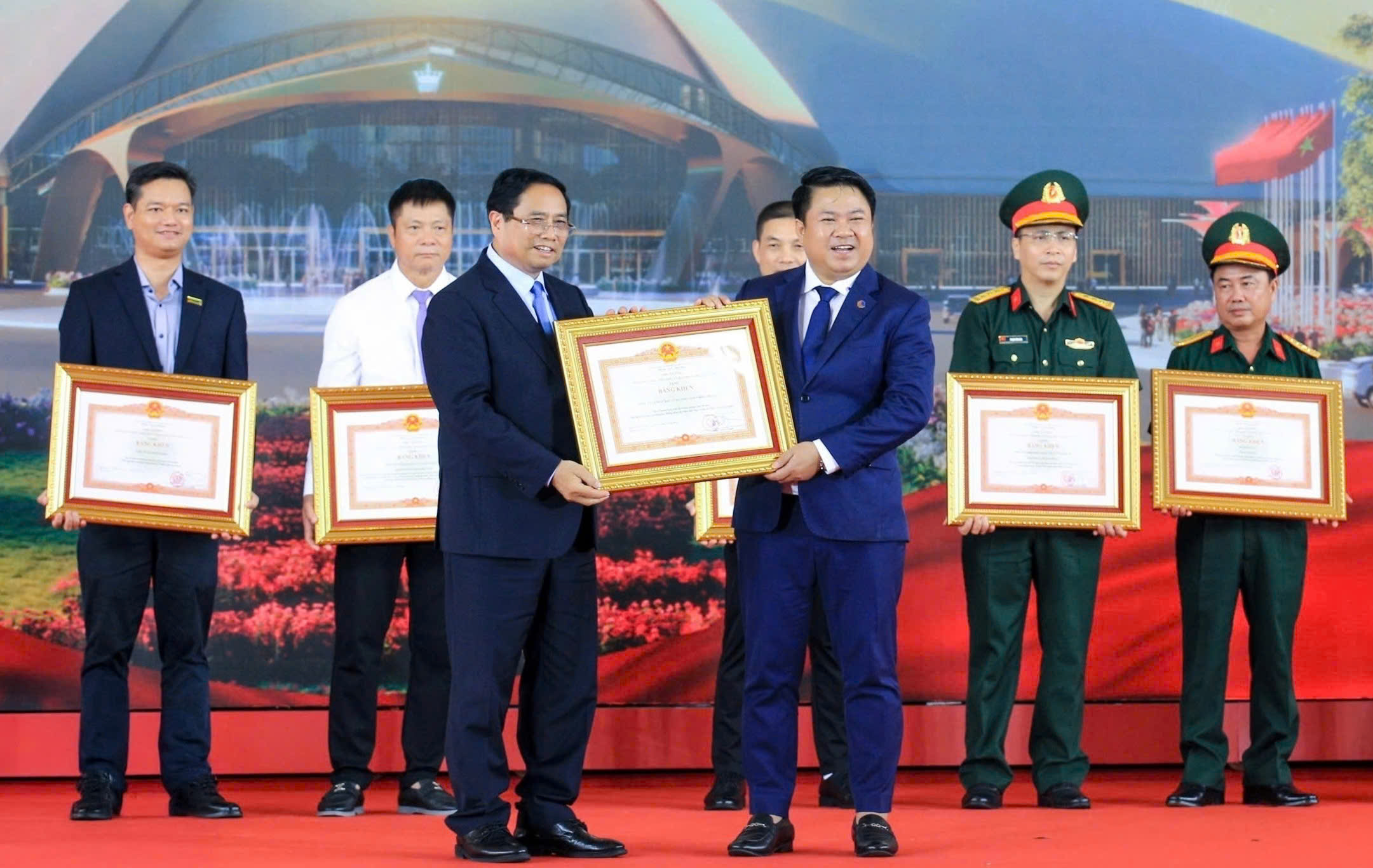

Mr. Ho Minh Hoang - Chairman of the Board of Directors of DEOCA Group shared at the conference

DEOCA, as the leading investor, is responsible for project preparation, bidding, management, and liaising with government agencies.

“We solve immediate tasks, create products, add real value to society, and work to improve policies and laws for the common good”, Mr. Ho Minh Hoang affirmed.

DEOCA categorizes investors and contractors with specific rights and duties to engage other businesses in project investments, fostering collaboration under the PPP++ model for mutual benefits.

BY LAM TRA